Blog

A more inclusive development

I announced in my Budget in end February to launch a new round of Consumption Voucher Scheme, and the $5000 voucher under Phase I of the Scheme has been disbursed since last week. The consumption sentiment of the market has been boosted. People are having different plans on how to spend their vouchers. Given the long validity period and flexibility of the vouchers, some people plan to first compare the concessions offered by different merchants and shopping malls, and to use the vouchers later when the epidemic situation further subsides. We also noticed that many merchants have extended their concessions and some have even planned for a second round of concessions later on to keep up the consumption sentiments, hoping that people would spend more when the epidemic is under control and the social distancing measures are relaxed, thus accelerating the pace of economic recovery.

In fact, the flexibility of the Consumption Voucher Scheme allows people to spend according to their needs and preferences, while ensuring that the money would circulate within the local economy to the largest extent. The Scheme can also strengthen and deepen the use and application of e-payment in Hong Kong, promoting digitalisation and bringing more opportunities to SMEs. I noticed that more and more small merchants are experimenting ways of online sales to explore new opportunities, such as adopting the model of “online promotion+ e-payment+ delivery logistics”. There are also more restaurants allowing customers to place orders through mobile phone, and some are even testing the use of mobile payments for customers to check the bill.

|

Changes in business operation models can always enhance effectiveness and flexibility, thus creating space for service innovation and reform. The consumption vouchers have played the facilitating and accelerating function for the digitalisation of Hong Kong’s economy. Apart from directly benefitting people, the Scheme also leverages on people’s consuming power to speed up the digitalisation of the economy. Taking the receipt of vouchers through Octopus as an example. On last Thursday, i.e. the first day of the disbursement of the consumption vouchers, about one million people collected their vouchers through the Octopus mobile app, which shows a 37% increase from last year, reflecting that people have become more acquainted with the use of convenient electronic means for accessing services.

Inclusiveness should also be taken into account in promoting economic development and developing industries. On one hand, it allows people to participate and be benefitted from the development, while on the other hand, it promotes the understanding and recognition by the community of the related industries. In other words, people can better share the fruit of development, and at the same time collective power and wisdom can be gauged to accelerate the development. Over the past few years, I have been promoting the development and the deepening of the bond market along this direction. All along organisational investors have been the major participants of the bond market. Yet the iBond and Silver Bond have opened up the opportunities for the mass public to participate. They also provide a safe investment option with stable return for people to hedge against inflation risk.

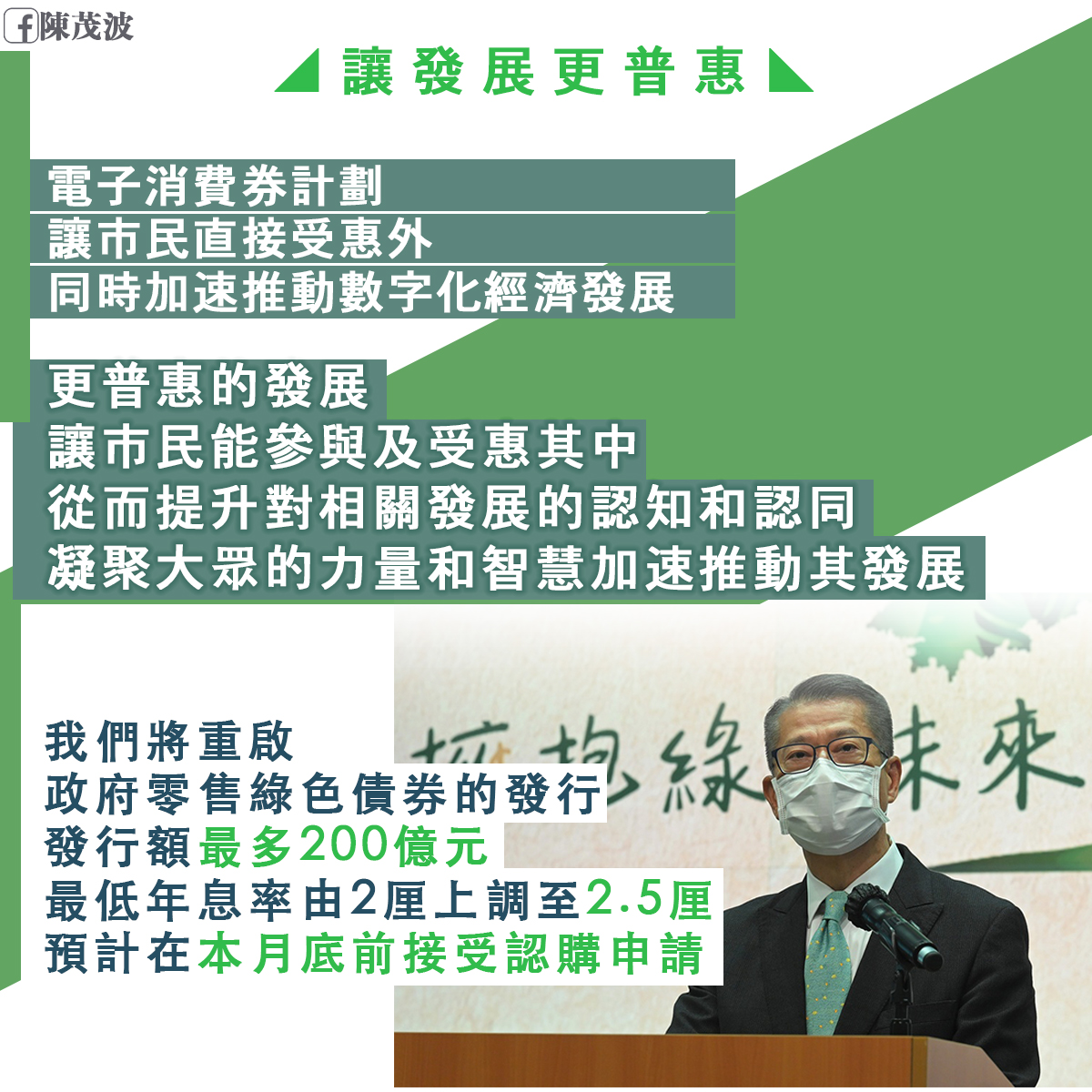

The development of Green Bond is another recent example. In my 2018-19 Budget, I established the framework for Green Bond. Since then, the SAR Government have been issuing Green Bonds for organisational investors to subscribe and the market reception has been very positive as seen from the bonds’ tenors and interest rates. In my Budget released early last year, apart from raising the borrowing ceiling of the Government Green Bond Programme to $200 billion, I also announced the inaugural issuance of retail Green Bonds for the participation of the public. The inaugural retail Green Bond offering was originally scheduled for early March this year, but has been postponed due to the then severe epidemic situation. Given the epidemic situation is gradually subsided, and many commercial activities can indeed be conducted online or through other electronic means amidst the anti-epidemic requirements, we will relaunch the issuance shortly.

The issue size of this batch of retail Green Bond will be $15 billion, which could be raised to the maximum of $20 billion taking into account market response. This has combined the postponed issue size of $6 billion of the last fiscal year and the issue size planned for the current fiscal year. This arrangement could save issuance cost and administrative work and allow greater timing flexibility for the later issuance of iBond and Silver Bond. Taking into account the hiking interest rate environment, we will raise the minimum annual interest rate of this batch of retail Green Bond from 2% to 2.5%. The tenor will maintain as three years and bond holders will be paid interest once every six months at a rate linked to local inflation. The subscription period is scheduled to open by end this Month. Proceeds raised under the Green Bond would be used for financing Government’s green infrastructures or related projects. In other words, by pooling in people’s capital to actively promote green development in Hong Kong, not only we could help people achieve their investment goals, but also bring more people to join hands in building a greener Hong Kong together.

April 10, 2022