Blog

Financial measures benefitting the public

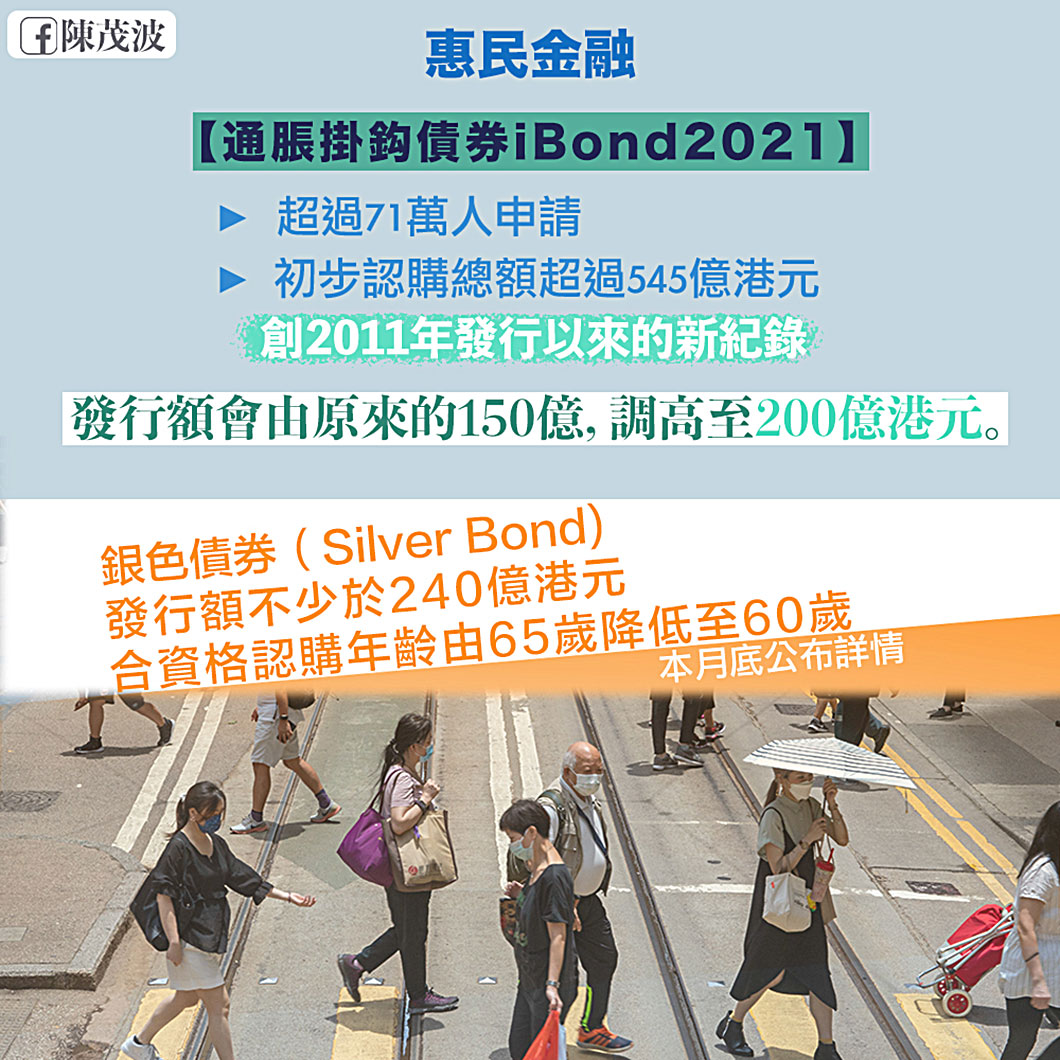

The subscription period of the latest batch of inflation-linked retail bond (iBond) just closed last week. It was received very well in the market, i.e. more than 710 000 applications for a total of HK$ 54.5 billion bond amount have been received, representing an increase of 55% and 40% respectively comparing to the previous batch issued last year. Both numbers have made a new record for iBond since its first issuance in 2011. In the light of the satisfactory subscription recorded, we will increase its maximum issuance size from HK$ 15 billion to HK$ 20 billion.

Following the issuance of iBond, we will soon announce the details of the issuance of the next batch of Silver Bond by end this month. I have already announced in the Budget this year that the maximum issuance size of this batch of Silver Bond will be no less than HK$ 24 billion and the eligible age will be lowered from 65 to 60, so as to provide the elderly with a stable and reliable investment option with fair return under the current low interest rate environment. At the same time, it can help promote the development of the high potential "silver hair" market.

|

When we prepared the Budget earlier this year, the inflation rate and interest rate were still very low around the globe, and the stock market was heating up. Under this circumstance, iBond and Silver Bond might not look attractive enough for investors. Nonetheless, our judgement at the time was that, the stock market will inevitably be volatile, and the easing monetary policy continued by many overseas major economies will lead to abundance of capital and mounting pressure of inflation, which will in turn trigger the demand for inflation-linked products with guaranteed minimum interest rate. We therefore have decided to issue another batch of iBond with an option to further increase the issue size, so that citizens could share the fruit of the development of our financial market, and further development of the local bond market can be promoted. When iBond was open for subscription over the past few weeks, coincidentally there was a mounting pressure of inflation in the US, and hence adding attraction to inflation-linked products and heating up the sentiment of iBond subscription. Promoting the development of Hong Kong bond market through issuing Government bonds could bring present and future benefits. This reflects that by taking a forward-looking mentality and making early preparations, we can achieve the effect of killing two birds with one stone.

We hope that the electronic consumption voucher scheme proposed in my Budget can also achieve a double benefit effect, i.e. boosting consumption and the economy, and at the same time promoting the widespread using of e-payment. The COVID-19 pandemic has popularised the acceptance and usage of e-payment and online sales. According to many surveys, the model of electronic transaction would be the major trend of growth for the future global market. If we lag behind our fast-paced neighbouring cities, the room of businesses for our local enterprise and small merchants will be undermined, the choices of products and convenience that could be enjoyed by consumers will be diminished. This could hinder the overall development of digital economy in Hong Kong.

As an international financial centre, although Hong Kong's financial services are having a robust development, there is a big room of improvement for e-payment and online sales on the consumption front. For instance, over HK$ 8.1 billion value of online sales was recorded in the first four months this year, reflecting a 53% increase compared with the same period last year, which is much higher than the 8.3% growth in the overall retail sales value. However, this fast growing online sales sector still only accounted for 7% of the total retail sales values in Hong Kong, much lower than that ratio in Mainland, which stood at over 20%. This tells that there is a huge room of growth for online sales in Hong Kong.

Moreover, merchants with physical stores gained a growth of 81% in online sales in the first four month this year, much higher than 28% increase in sales gained by those only operating online stores. This reflects that traditional merchants are also actively exploring online sales to seek driving force for business growth.

While one may be attracted by the concessions offered by e-wallets and other cross-sectoral promotions, or the convenience of online shopping in using e-payments, its widespread use among consumers and merchants will in any case be a pivotal foundation for future growth of Hong Kong's retail market.

The electronic consumption voucher scheme not only provides extra money for our citizens to spend in consumption, but also helps to bring the community together to promote the wider application of electronic consumption and facilitate small merchants to further tap in electronic platforms to explore more business opportunities. If local merchants are given opportunities to carry out more cross-sectoral promotions, our economy and market could be further energised with new ideas.

In fact, with our efforts against the virus showing effects gradually and more and more people getting vaccinated, Hong Kong's economy has been picking up its impetus after suffering from the epidemic for more than one and a half year. Not only the GDP is seeing a rebound, but improvement is also shown in the labour market. For instance, the unemployment rate has been receding from 7.2%, a 17-year peak, at earlier this year. Given the pace of improvement in recent months, the unemployment rate to be announced will soon come down to nearly the level of that one year ago. Nonetheless, it is still far from the situation of almost full employment before the outbreak of the epidemic.

To facilitate an economic recovery to its largest extent, it still requires effective measures against the epidemic and resumption of cross boundary travel with the Mainland and other places. Getting vaccinated not only helps protect yourselves and your families, but also facilitate the society and people's daily lives to resume normal.

The rolling out of the electronic consumption voucher at this point of time helps to build up a positive atmosphere for people to consume, create more business opportunities for the merchants, and promote the use of e-payment in Hong Kong. Every dollar we are going to spend today will bring present and future benefits. The preparation of the electronic consumption voucher scheme is at its final stage. We will soon announce the scheme details, including the arrangement for registration and disbursement. Registration is expected to start next month.

June 13, 2021