Blog

Finding a new way out amid the evolving environment

Entering December, the consultation work for the Budget has officially started. My colleagues and I are gearing up to exchange views with representatives and stakeholders from different sectors on how to make good use of public resources to promote economic and social development, and to improve people’s livelihood. Taking into account the recent epidemic situation, most of the consultation sessions this year will be conducted online, so that we can continue to understand the concerns and opinions of different sectors.

For every year’s Budget, it is fundamental to estimate the Government’s revenue and expenditure. Through the allocation of resources, we on the one hand promote economic development or restructuring, and assist enterprises in exploring business opportunities. On the other hand, with the cooperation of policy bureaux, we roll out initiatives to improve people’s livelihood and enhance social services. Most of you may already have an idea about the Government’s fiscal situation this year: a deficit of more than $300 billion, which will be the largest deficit in Hong Kong’s history. In previous years when huge surpluses were recorded, everyone focused on how the Government could allocate these surpluses to enhance services and share the fruits with the people. Now we are going to face an unprecedented huge deficit this year, how should it be dealt with in your view?

|

Perhaps, we must first understand the origin of the deficit. In the face of the economic downturn since the middle of last year, the damage to the society and people’s livelihood as a result of violent acts, as well as the pressure on the economy caused by the epidemic at the beginning of the year, I introduced relief measures totalled over $120 billion in the Budget. These are mainly one-off expenditures and will not constitute long-term fiscal burdens. As for the three rounds of Anti-epidemic Fund measures, their nature is similar.

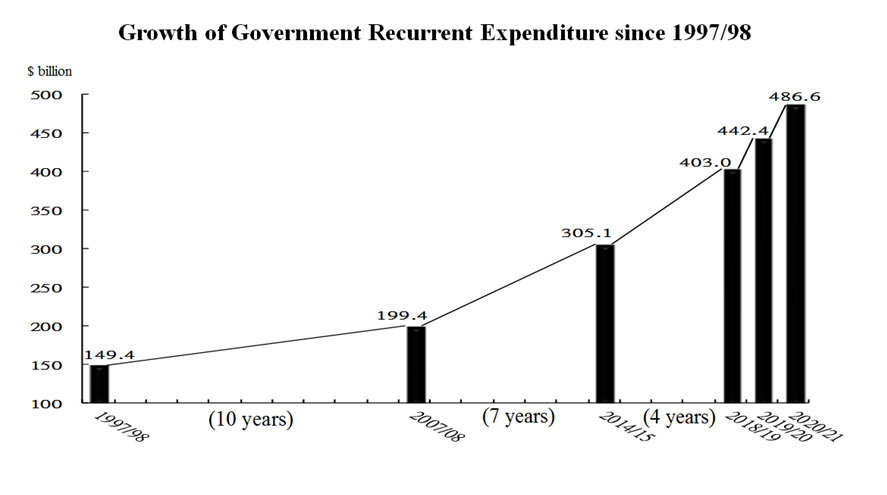

Economic cycles have their own patterns and usually fluctuates, but fiscal deficit may last for a prolonged period of time during down cycles. Take, for example, the economic downturn from 1998/99 to 2003/04 triggered by the Asian financial crisis, fiscal deficits were recorded in five out of these six years, and the Government’s fiscal reserves dropped sharply from the equivalent of 28 months of Government expenditure early in the period to about 13 months at the end of the period. In contrast, the rate of fiscal reserve depletion has been very rapid amid the current economic downturn. From the equivalent of 23 months of Government expenditure at the beginning of the year, the fiscal reserves fell sharply to only about 14 months of expenditure in a years’ time. Although it is understandable to increase expenditure by rolling out one-off measures under special circumstances, still we cannot take it lightly in the face of a surge in deficits and a drastic drop in reserves. In particular, the Government’s recurrent expenditure is approaching the level of $500 billion a year, more than three times than that in 1997!

Why do I particularly emphasise the need to stay vigilant about the rate of increase in recurrent expenditure? Because this could pose potential structural challenges to our public finance and also affect the financial stability of Hong Kong. Last year our society was scarred by violent acts, this year we have to brace for the impact of the epidemic and the so-called sanctions imposed by the US. These have all affected economic and financial market sentiment, and even sparked concerns about the stability of the Hong Kong dollar. In fact, under the Linked Exchange Rate System, Hong Kong cannot cope with economic ups and downs through monetary policy or exchange rates adjustment. In this connection, a strong and stable fiscal strength of the SAR Government has become one of the important pillars for stabilising market confidence.

Even small numbers accumulate over time. We must exercise extra caution in dealing with recurrent expenditure as they will have a profound effect on the public finance once showing a compound increase. In the first ten years after Hong Kong’s return to the Motherland, the recurrent expenditure of the SAR Government increased from $150 billion to $200 billion, i.e. just an increase of $50 billion. In the ensuing seven years, the recurrent expenditure rose by $100 billion to $300 billion (in the fiscal year 2014/15). After that, it only took four years to hike to $400 billion (in the fiscal year 2018/19). The growth pace accelerated further in recent years. It is estimated that the recurrent expenditure will get close to $500 billion in the fiscal year 2020/21. This has yet to take into account the 10 new initiatives to improve people’s livelihood as announced by the Chief Executive early this year, such as lowering the eligible age threshold for the $2 transport fare concession scheme from 65 to 60, which alone would induce an additional recurrent expenditure of $6 billion a year. With the ageing population, the corresponding additional expenditure will grow at a rapid pace.

|

In this year’s Budget, I have already pointed out that Government expenditure will enter a period of consolidation, and it is necessary to focus on making good use of resources. As for the pace of increase in recurrent expenditure, we must pay more attention to the Government’s long-term fiscal affordability, and ensure that it is commensurate with the growth in revenue. Therefore, in the early stage of compiling the next year’s budget, we have instructed all Government departments to maintain “zero growth” in establishment. When launching new services or enhancing existing services, all departments must do so by reorganising or redeploying their existing resources first.

However, as the Hong Kong economy is currently in a down cycle, I will maintain a proactive fiscal policy, stimulating demand primarily through investment expenditure on public works and non-recurrent expenditure, so as to ease the pressures brought about by economic adjustment. As such, it is estimated that the fiscal year 2021/22 will still see a deficit budget. In fact, in the middle of this year, I have asked relevant departments to expedite the launch of minor works in order to increase employment opportunities in construction-related industries and also benefit the other sectors. In addition, apart from continuing to provide liquidity support to SMEs through the SME Financing Guarantee Scheme and other measures, we also keep engaging with various sectors of the community to explore how to further support the hard-hit industries.

In any case, it seems inevitable for the overall Government expenditure to increase and revenue to decrease in the next fiscal year. How to raise revenue and cut expenditure down the road is an extremely difficult issue. In this regard, the Tax Policy Unit under me is conducting research and assessment. However, during an economic downturn, it is inherently contradictory and difficult to talk about reducing expenditures and boosting tax revenues while refraining from suppressing the momentum and confidence in economic recovery. Also, it is not easy to conform to the concept of countercyclical fiscal policy. Besides, as a small and open economy, the recovery and development of the Hong Kong economy in future will also be governed by various uncertainties in the global landscape, including the evolving China-US relations, geopolitical tensions, changes in the international tax environment, as well as the politico-economic relations and the pace of economic recovery among China, Europe, the US and the Asian region. It is no doubt very important for the SAR Government to exercise caution when managing recurrent expenditure. What is even more important is to create revenue through promoting economic development and finding new growth spots. How to “create new opportunities out of crises and open up new prospects in changing circumstances” is worthy of our deep contemplation.

December 6, 2020