Blog

The biggest obstacle to recovery

The Budget this year, which proposes supporting measures amounting over $120 billion, was approved by the Legislative Council last week. I would like to express again my gratitude to the 42 Legislative Councillors who cast a supporting vote, allowing the implementation of the relevant Budget measures including tax cut, rates reduction, as well as the disbursement of $10,000 to eligible Hong Kong citizens. Some Budget measures focus on providing support to workers and enterprises and relieving people's burden, while some aim at economic development and the building of a liveable city. In short, the approval of the Budget will facilitate the all-round development of our economy.

The various measures proposed in the Budget are now in the pipeline. For the $10,000 cash payout scheme, we are going to sign service agreements with the 20 plus participating banks for making the disbursement through their channels as well as the Hong Kong Post. Our plan is to start the registration by end June. To register online through banks and receive the disbursement through sole name bank account will be the quickest way to get the money, in around mid July.

At the same time, we have engaged the retail and catering sectors and encouraged them to roll out promotion and concessionary campaigns to create an atmosphere and boost local consumption.

Apart from boosting consumption and businesses for shops, it is also important to provide liquidity to enterprises to relieve their operating pressure in this testing time. The 100% guarantee concessionary loan product proposed in the Budget has been open for application since last month. Until last week, the Hong Kong Mortgage Corporation Limited (HKMC) had received more than 2,500 applications involving a total loan amount of more than $4.4 billion within three weeks. In general, a loan application with sufficient information submitted could be approved within three working days, while about 60 per cent of the applications received were approved within the same day. We understand from many enterprises from different sectors that the product is useful in meeting their urgent financing needs. We also learned from HKMC that one of the applicant enterprises is a small won-ton noodle shop which has been operating in Hong Kong for several decades. The loan product not only help supporting the shop and the jobs of their employees, but also help preserving a taste of memory in the community.

|

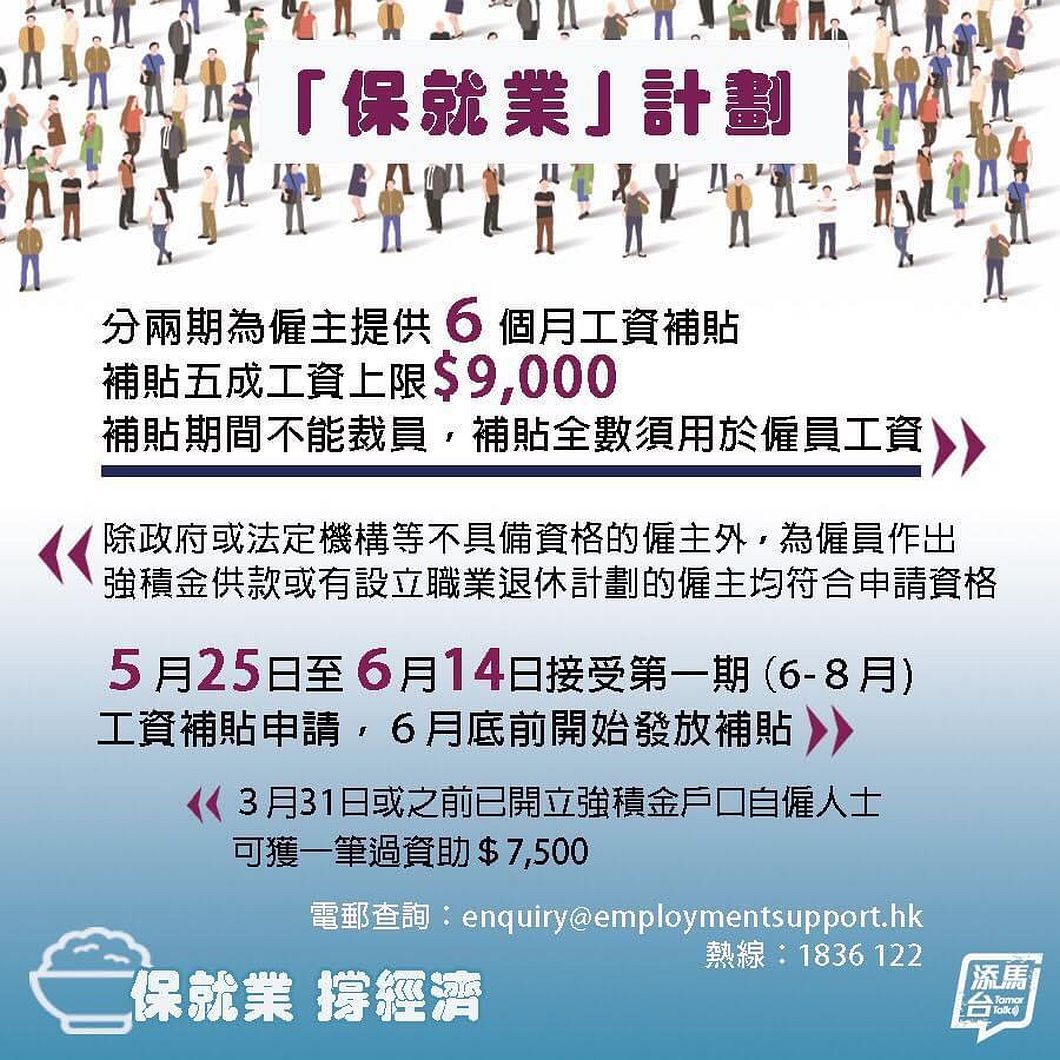

After twenty-plus days of zero confirmed local case of COVID-19, the reoccurrence of the few new local cases last week has added uncertainty to the originally improving situation. Hong Kong's economy is still struggling in a deep recession. While Q1 GDP has already seen an 8.9% contraction, the worst since record, we could hardly be optimistic for Q2. The employment situation is also getting worse. The increase of unemployment rate has been speeding up from a pace of 0.1 percentage point in January to 0.5 percentage point in March, leading to an unemployment rate of 4.2% in March. As many businesses have been disrupted by the social-distancing measures implemented since end March, we have seen from time to time employees taking unpaid leaves, facing pay-cut or being laid off. It is expected that the unemployment rate in April will surge and the situation of underemployment will further deteriorate. All these will lead to shrinking income and hence greater pressure in making a living and supporting families. The Government has already announced the $80 billion Employment Support Scheme to provide wage subsidy to employers for a period of time to achieve job retention, which can in turn help alleviating the unemployment problem to some extent. The Scheme will start receiving application next week.

As COVID-19 is highly contagious and many of those infected show mild or even no symptom, we may need to prepare for a long-time coexistence with the virus before the discovery of any effective vaccine. When putting forward measures against the pandemic, we have to strike a right balance between our efforts in fighting against the virus and stabilising the economy, so that struggling enterprises could have a chance to survive while ensuring public health. This is also crucial in preserving the vitality of our economy.

Nonetheless, a stable social environment is even more crucial. If the pandemic subsides, but violence returns, it will drive away international investors and hamper local consumption, which in turn drag down the recovery of our economy. With many people and businesses already hard hit by the economic recession, it would be irresponsible and irrational to still advocate the concept of "burning together". This in fact may be the biggest obstacle to Hong Kong's economic recovery.

May 17, 2020